How UnitedHealthcare and other insurers use AI to deny claims

In This Story

The fatal shooting of UnitedHealthcare ( UNH 2.63% ) CEO Brian Thompson on Wednesday has sparked public scrutiny of health insurers, especially regarding their use of AI in evaluating claims. The incident also comes as several insurance providers have been facing litigation over their coverage practices and the potential impact they have on patient care.

Suggested Reading

Microsoft and Gretel team up to drive AI innovation

Suggested Reading

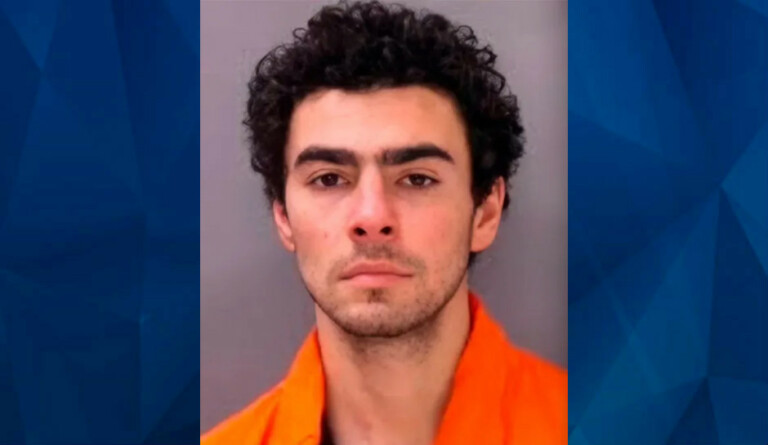

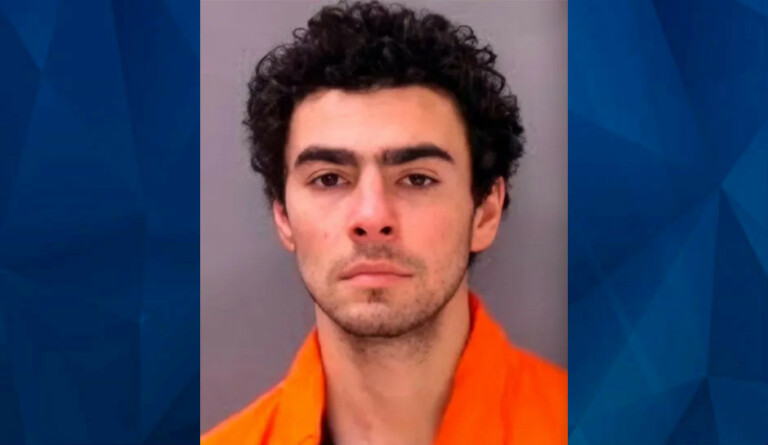

Thompson was fatally shot in New York City on Wednesday morning, just hours before he was set to speak at the insurance firm’s annual investor day.

Multiple outlets reported on Thursday that shell casings from the shooting had the words “deny,” “defend,” and “depose” written on them. The words appear to reference terms industry critics use to describe how insurers deny claims.

At the same time, posts on social media have been claiming that UnitedHealthcare’s claim-denial rate is the highest in the industry ; however, since insurers try to keep these numbers hidden, the true extent of its denials remains uncertain, especially when it comes to private plans.

Still, some recent reports show that denials for some patients have been on the rise.

In October, a report from the U.S. Senate Permanent Subcommittee on Investigations showed that the nation’s insurers have been using AI-powered tools to deny some claims from Medicare Advantage plan subscribers.

The report found that UnitedHealthcare’s denial rate for post-acute care — health care needed to transition people out of hospitals and back into their homes — for people with Medicare Advantage plans rose to 22.7% in 2022, from 10.9% in 2020.

The rise coincides with UnitedHealthcare’s implementation of an AI model called nH Predict, originally developed by naviHealth, a subsidiary of UnitedHealth Group that has since been rebranded .

Algorithms like nH Predict can analyze millions of data points to generate predictions and recommendations by comparing patients to others with apparently similar characteristics, according to an article on JAMA Network . However, the article cautions that claims of enhanced accuracy through advanced computational methods are often exaggerated.

Both UnitedHealth and Humana are currently facing lawsuits over their use of nH Predict. The suits allege that insurers pressured case managers to follow the algorithm’s length-of-stay recommendations, even when clinicians and families objected.

One lawsuit filed last year against UnitedHealth claims that 90% of the algorithm’s recommendations are reversed on appeal.

The lawsuit states that UnitedHealthcare wrongfully denied elderly patients care by “overriding their treating physicians’ determinations as to medically necessary care based on an AI model that Defendants know has a 90% error rate.”

In court filings, lawyers for UnitedHealth argued that the lawsuit should be dropped because plaintiffs failed to complete Medicare’s appeals process and that their grievances are with the federal government and not UnitedHealth, STAT News reported in May.

UnitedHealthcare and Humana ( HUM 5.46% ) did not immediately respond to requests for comment from Quartz.

Cigna ( CI 1.03% ) is also facing legal action over its use of a separate algorithm to reject insurance claims. A 2023 lawsuit alleges that the company uses its PxDx system to analyze and deny claims in bulk before forwarding them to physician reviewers for final approval. Cigna relies heavily on the automated system, allowing claims to be denied without any review of individual patient files, according to the complaint. It cites a ProPublica investigation revealing that a single Cigna medical director rejected 60,000 claims in just one month.

Cigna also did not did immediately respond to a request for comment from Quartz.

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com